Tick the check box “The beneficial owner derives the item (or items) of income for which the treaty benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with limitation on benefits. Tick the check box and write “Australia”. That is the easy first 2 pages taken care of! Now to Part III (you can skip Part II). I suspect in the end it doesn’t matter too much since the ATO has the ability to crossmatch your ABN and TFN – the whole point of this form is for the IRS and ATO to share data on company income. I am much happier to supply people with my ABN rather than TFN. Technically, your company’s tax file number is the TIN, but some sources suggest that you supply your ABN, not TFN (others say TFN). For “Foreign TIN” write in your company’s ABN.Įdit. Write your registered business address in Australia Don’t tick the “yes” or “no” box for the line “If you entered disregarded entity, partnership, simple trust, or grantor trust above, is the entity a hybrid making a treaty claim? If “Yes” complete Part III.”

Print out the form as it is easier to fill it in by hand and scan.

If the form has moved then just google for it – the IRS seems to like to move forms around on their website fairly regularly.Ģ.

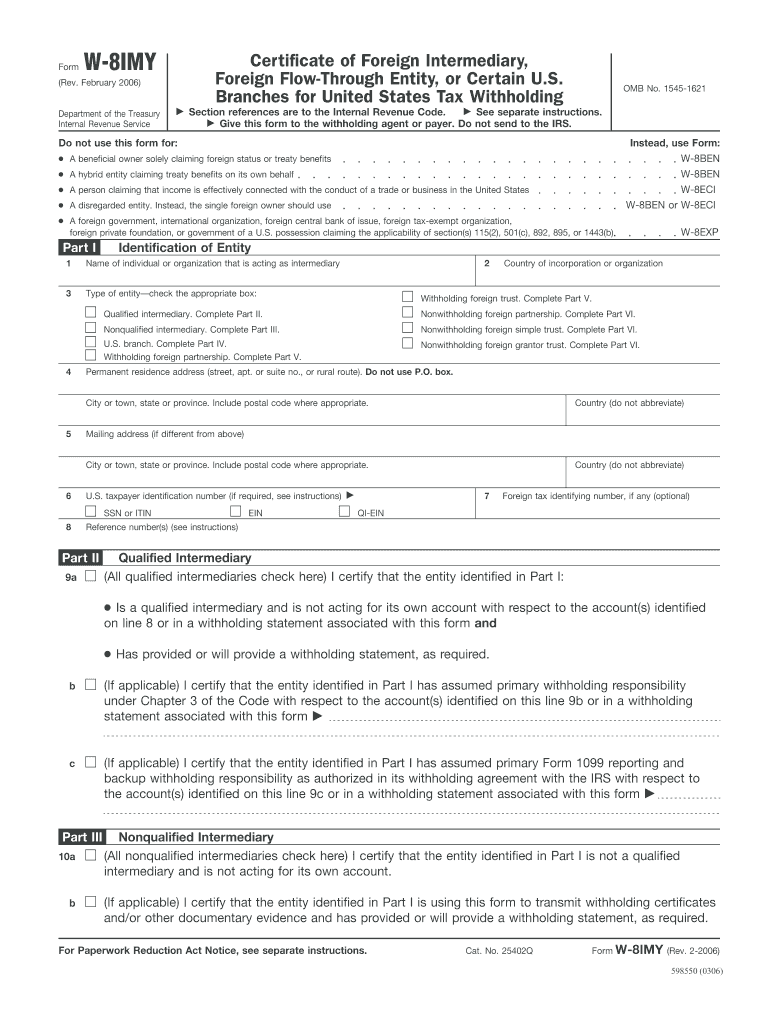

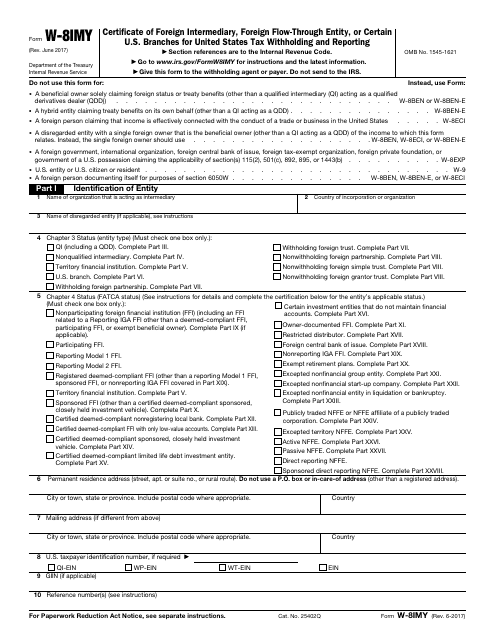

#W8 imy instructions download#

You can download the W-8BEN-E from the IRS website. I have updated the instructions again – this post is never going to die.ġ. Thanks to the IRS for making this post evergreen.Įdit 4 (2021). The IRS has made the form even more confusing again so I have updated the instructions. I am sure everyone will be surprised to learn it is even more complex.Įdit 3 (2019). Once again the IRS has updated the form in 2017 and so the tread mill continues. Amazingly they have made the form even more complicated – there really is no form too complicated that the IRS can’t make it worse.Įdit 2 (2017). The IRS updated their form in 2016 so I have updated the instructions.

Do not use these instructions if you are a US citizen or have a US company branch.Įdit (2016). I am not a USA tax lawyer or accountant! Use this guide as a starting point for knowing what you need to do and always consult a professional. those owned and run by Australians) of what you need to do.* To save other poor Australians the nightmare of completing the W-8BEN-E form here is my step-by-step guide for standard Australian companies (i.e. When faced with completing this form for the first time it is near impossible to know what you need to fill in and the IRS instructions are as clear as mud. This form is eight long pages of IRSese with such easy to understand terms as “Nonparticipating FFI (including a limited FFI or an FFI related to a Reporting IGA FFI other than a registered deemed-compliant FFI or participating FFI)”. If anyone know what this means please post, because nobody at the IRS seems to know – at least nobody who answers the phones.

If you are a foreign business with no presence in the USA, but you have US customers, you need to complete and provide your customers with a copy of the W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). The IRS seems to be over just making the life of Americans a misery and they have decided the whole world should experience their special attention.

0 kommentar(er)

0 kommentar(er)